We’ll always save your work, so you can pick up where you left off anywhere, on your own device and on your own time. Once you are able to reach a TurboTax representative on the phone they will be able to look at your account and process a refund if necessary.

PLEASE Do The Right thing and return my money to my account. Your site seems to be a rip off as I’ve heard from others with similar stories. Im still waiting for an answer I asked last week as to why Intuit charged me $77.00 when they realized the 1040 EZ form was best for me, which should have been free. I filed on January 20 and it says it was accepted but at the end it says that to print and mail but I chose to have direct deposit so im confused. Will never use and will attempt to share this review wherever and whenever anyone asks about it. Here is the list of forms supported by H&R Block’s “free online” version. If you clicked on this “FREE Guaranteed” option, you could input a lot of your information, only to be told toward the end of the process that you need to pay. To securely send Justin documents or other files online, visit our SecureDrop page.

Justin Elliott is a ProPublica reporter covering politics and government accountability. In January and February, taxpayers tend to have simple situations, know they’re due a refund and want that money as soon as possible. That’s the taxpayer who is probably going to get charged a lot more for online, do-it-yourself tax preparation. Then, again and again, they put tax time off - to tomorrow night, to next weekend - until the task can’t be delayed any longer. From January to April, they carry around a dread of what they might owe and what the IRS might do to them if they make a mistake. Many Americans have trouble just thinking about their taxes. While its tax coverage is comprehensive, its user interface and help system don’t fare well against the competition.

TURBOTAX FEDERAL FREE EDITION PRO

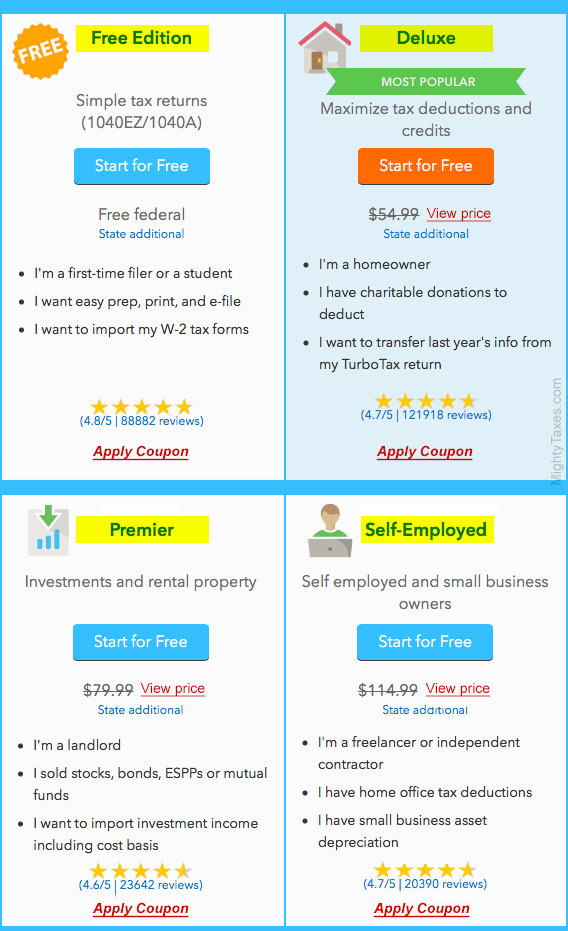

It has new, attractive pricing and an option to let a pro prepare your entire return. Online tax service Jackson Hewitt gets the job done. It takes longer for a check to be sent then it does for direct deposit, so I would go with direct deposit if you need the money sooner. You can click “No Thanks” and move through the 1040EZ without any TurboTax additional charges. Take your time because there are prompts that offer additional charges to your refund if you select them. It may be time to be quiet, and spend the next 6 weeks doing some self reflecting. Susan how can you blame someone else for using a DD number on your own closed account? Better yet, how could you not know your own account was closed? And for the record…… I doubt your family and friends are thinking turbo tax is the idiot here. I actually work for one, donate my time and expertise. There are free tax preparation services Nation Wide. Contact them to see if you qualify or to find a location near you. Free tax preparation services are available for low- to moderate-income taxpayers through AARP and CASH Oregon. Which forms are free and which will trigger a fee depends on the company. The widely advertised “free” options are typically only really free based on which tax forms you need to file. Keep in mind that some locations may require an appointment. Taxslayer Classic 2019 Mobile (tax Year Review TaxSlayer’s Free Basic edition is limited to 1040EZ a state tax return costs $28.99. TaxAct offers a free federal return for taxpayers who file a 1040EZ or 1040A, with no charge for a state return.

TURBOTAX FEDERAL FREE EDITION FOR FREE

You can prepare and e-file a federal return for free a state tax return costs $29.99.

In addition to the TurboTax Federal Free Edition, taxpayers with simple returns can use H&R Block’s Free Edition (/online-tax-filing/free-online-tax-filing). The IRS Free File program allows you to submit your federal taxes for free, even if you’re using an app like TurboTax. TurboTax asks you simple questions about you and gives you the tax deductions and credits you’re eligible for based on your answers. Remember with TurboTax there’s no need to know tax laws.

Taxpayers can visit and start their tax return today. If you’re ineligible for Free File but want more hand-holding than the fillable forms provide, you may still be able to prepare and file your federal tax return for free. H&R Block’s online product charges for a state return, but its free federal return covers a wider swath of simple tax situations than the 1040A and 1040EZ. This year, TurboTax and TaxAct, which has matched its competitor’s offer, were still offering free federal and state filing as of March 8. Last year, TurboTax ended its “Absolute Zero” offering - charging nothing for both federal and state returns for taxpayers with the simple 1040EZ and 1040A forms - in mid-February.

0 kommentar(er)

0 kommentar(er)